The past year will be remembered as a moment of reckoning for central banks. The relentless wave of cheap money provided by policymakers set the bond market racing higher, spreading negative yields throughout the financial system and prompting many rate-setters, bankers and investors to wonder whether they could really control the monster they had created.

The Federal Reserve’s policy U-turn that set it on course for rate cuts put investors in a spin. Ructions in the repo market caused plenty of angst. And President Trump shook currency markets with a series of off-the-cuff remarks.

Here, FT reporters around the world look back on the big moments and personalities that defined 2019 in markets. Enjoy.

January 2

The yen starts the year with a bang

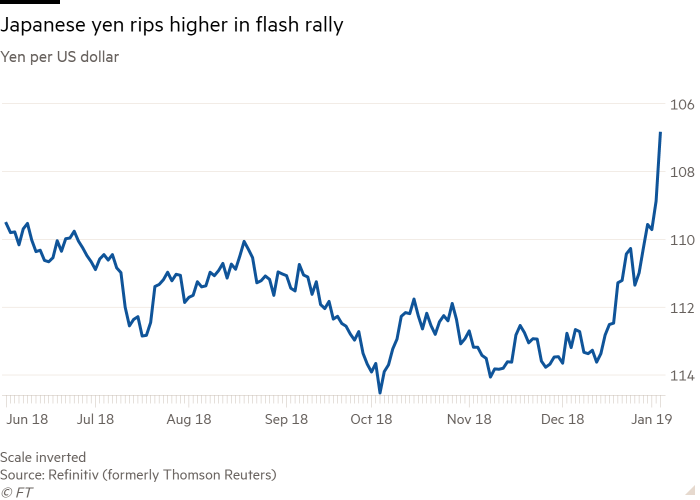

As traders were recovering from the holiday season, just before 11pm London time on January 2, the Japanese currency suddenly, and without any obvious reason, leapt by 3 per cent against the dollar in a matter of seconds. Other currencies convulsed, with the Australian dollar briefly hitting a 10-year low.

Central banks and regulators later struggled to explain what caused the swings, before settling on very thin trading in the so-called “witching hour” that happens every day between 5pm and 6pm New York time. Still, as exciting as the start of the year proved to be, currencies spent much of the year in a slumber, with volatility collapsing to record lows. Eva Szalay

January 30

The Federal Reverse

The US central bank closed out 2018 by raising US interest rates for the fourth time in 12 months and warning that additional increases were on the way.

Six weeks later, not only did the Fed put further rate rises on hold, but it signalled it would instead consider easing policy, leaving investors reeling. In July, it initiated the first of three cuts.

The January U-turn reflected a big shift in the central bank’s views about the health of the US economy and its ability to shield itself from risks. Now the Fed is waiting for a “material” change in economic conditions before pulling the lever of monetary policy once more. Colby Smith

April 9

Saudi Aramco’s (first) record fundraising

State-owned energy company Saudi Aramco set records in 2019, drumming up a whopping $100bn of demand for its debut $12bn international bond sale — before going on to land the world’s biggest IPO in December.

The demand for the bonds was the strongest ever seen in an emerging market and marked a watershed for the world’s largest oil company as it opened its books for the first time.

It also highlighted the peculiarity of the way bonds are sold, given that the initial frenzy of orders failed to lead to much demand when the bonds began to change hands, and sank as low as 95 cents on the dollar. In big transactions like this, it has become routine for investors to overstate how much of the bond deal they want to buy. Joe Rennison

June 3

Neil Woodford meets his match

Neil Woodford’s eponymous investment firm sent shockwaves through London in 2019, announcing that it had blocked redemptions from the star stock picker’s flagship £3.7bn fund.

The root of the problem was that while the fund offered investors the ability to withdraw their money daily, it was heavily invested in assets that could not be sold easily. This type of liquidity mismatch earlier sparked a crisis at Swiss asset manager GAM in 2018, but the unravelling of Mr Woodford put the issue front and centre.

Liquidity became a watch word for the year. When the FT revealed that H2O Asset Management had large holdings of illiquid bonds linked to a racy German financier, it suffered €8bn of investor withdrawals. Funds are now thinking harder about how to handle potential rushes to the exits. Robert Smith

June 18

Shots fired in the currency war

The middle of 2019 brought evidence that Donald Trump was paying attention to the European Central Bank’s pronouncements. “Very unfair to the United States!” he tweeted after the ECB signalled plans for a fresh round of stimulus.

Mr Trump made it clear he thought this represented an effort to weaken the euro, “making it easier for [the eurozone] to compete against the USA”.

Market participants started taking the possibility of a global currency war seriously and contemplating how it might work. Since then, the US president has also lashed out at Brazil and Argentina, levying tariffs on their metals exports in retaliation for what he labels their currency “devaluations”. Katie Martin

August 5

Renminbi ‘cracks seven’

The People’s Bank of China allowed the renminbi to fall past Rmb7 per US dollar for the first time since the depths of the 2008 financial crisis, raising echoes of the fallout from the currency’s shock devaluation of 2015.

But “cracking seven” did not lead to a repeat of the drama three years ago, which prompted major capital outflows and drew the ire of critics in Washington who accused Beijing of currency manipulation.

This time, the breach drew the ire of President Trump. But the controlled fall, aided by capital controls introduced since 2015, suggested that Beijing had another tool at hand to cushion the blow from US tariffs. Hudson Lockett

August

The hot summer that put bond yields in the deep freeze

Red-hot demand for bonds turned the laws of finance upside down in 2019. At the peak in late August, $17tn of debt was trading with a negative yield, meaning investors buying bonds and holding them to maturity were guaranteed to make a loss.

Traditional havens such as Japan and Germany dominated, but the phenomenon spread into surprising areas like short-term Greek debt and a handful of emerging market bonds, as yield-starved fund managers reached further afield in search of something offering a positive return.

A backlash came in the autumn as investors began to question whether the economic backdrop was really gloomy enough to justify locking in losses. At the same time, concerns about the nasty side-effects of negative yields for pension savers and the banking sector clouded the prospects for even more rate cuts. Tommy Stubbington

August 11

A shock for Argentina’s bondholders

Wall Street-darling incumbent Mauricio Macri lost to leftist candidate Alberto Fernández in the country’s primary presidential elections, paving a path for Mr Fernández’s victory two months later. Argentina’s assets faced a drubbing.

Some of the country’s dollar bonds suffered a 40 per cent drop in value, while the peso plummeted 20 per cent.

Mr Macri was forced to enact a series of emergency measures to stave off a full-blown crisis. He instituted capital controls to stop the drain of dollars from the country and announced that the government had sought to delay payment on $101bn of debts. That sparked fear among debtholders that the country was hurtling towards its ninth default. Colby Smith

August 19

Rewriting the rules on shareholders

On a sultry Monday in August one of America’s biggest pro-business lobbying groups said it was redefining what it means to be a company. Investors, board members and legions of lawyers are still trying to figure out exactly what that means.

The Business Roundtable said that shareholders would no longer be the primary beneficiaries of corporate activity. The 181 signatories to the policy shift said that “we share a fundamental commitment to all of our stakeholders”, including suppliers, workers and the communities they inhabit.

The change was a reversion to a policy prior to 1997, but it sent the business community into a tizz. For some, it was a gimmick lacking an enforcement mechanism. It might have also represented an attempt to ward off tax and regulatory reforms in the US ahead of an election. Still, it may actually mean something in the years ahead. Patrick Temple-West

September 11

Charles Li’s love letter to London

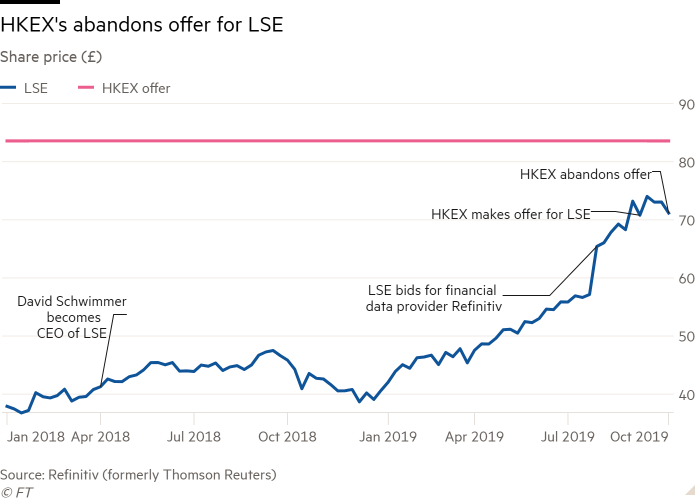

Hong Kong Exchanges and Clearing created waves when it made an audacious £32bn approach for the London Stock Exchange Group.

HKEX, which had never attempted such a large deal before, had grand ambitions to unite London’s capital markets with those in China. But what prompted the bid proposal was that a hostile LSE board had just agreed its own blockbuster deal — a $27bn purchase of Refinitiv, the data and trading group. HKEX saw this as a bad deal for an exchange group it had always admired from afar, and stepped in to try to break up the engagement.

But HKEX boss Charles Li’s efforts to focus on the deal’s commercial benefits were almost immediately drowned out by political concerns. It could not persuade enough of its own shareholders, nor those of the LSE, to make a formal bid. It gave up a month later. Philip Stafford

September 16

Oil soars, then slumps, as Saudi attacks fizzle out

Oil prices soared almost 20 per cent after missile and drone attacks knocked out more than half of Saudi Arabia’s production. It was the biggest one-day move in the market since Saddam Hussein invaded Kuwait in 1990.

Trading volumes across New York and London smashed daily records, with the equivalent of more than 5bn barrels changing hands as investors scrambled to adjust their positions, fearing a prolonged disruption in supplies from the world’s largest crude exporter.

But the rally would eventually prove to be shortlived as Saudi Arabia was able to tap oil in storage to help keep customers supplied. Meanwhile, traders were wrongfooted by the speed at which the kingdom restored the majority of its production capacity.

That the attacks did not lead to a wider confrontation with Iran, which was blamed by the US for carrying out the strikes, meant that prices stabilised in little over a week. David Sheppard

September 16

Grim repo

The sleepy market for sourcing short-term cash loans in exchange for Treasuries and other high quality collateral woke up with a start and borrowing costs soared.

The sharp move (explained in full here) began to ease only when the Federal Reserve announced it would inject billions of dollars into the market.

The episode was initially blamed on a funding squeeze created by tax payments coinciding with investors settling up Treasury purchases with the US government.

But with hindsight, bankers, investors and policymakers have said it exposed structural fragilities at the heart of the arcane — but crucial — market. Banks have grown reluctant to lend out cash held to satisfy tougher post-crisis rules on liquidity, at the same time as demand has become amplified by the growth of highly leveraged hedge funds. Joe Rennison

September 30

WeWork’s stock market dalliance ends

WeWork delivered the year’s most high-profile IPO slip-up when it scrapped plans to list shares after investors voiced concerns over its governance and leadership.

The office space provider fired its chief executive Adam Neumann, who was the focus of reports he had smoked marijuana on a corporate jet and was enjoying a lavish lifestyle on the company’s dime. The group’s valuation crumbled from $47bn in its last round of private fundraising in August 2018 to just $8bn, according to the terms of a rescue package swiftly arranged by SoftBank. The Japanese company was the group’s largest shareholder, through its Vision fund.

Big companies widely expected to list put their plans on ice, while investment banks began pricing new IPOs more conservatively.

Some of the most anticipated deals of the year have also disappointed. Shares in Uber, the largest with $8.1bn raised, cratered by nearly half in the six months after listing. Lyft, the third biggest IPO of the year, also sank. Richard Henderson

November 1

Draghi bows out

Mario Draghi’s tenure as president of the European Central Bank ended, leaving him to hand over the reins to IMF director Christine Lagarde.

Mr Draghi departed with a repeat of a plea he had been making increasingly loudly over the previous few months, for governments to do their part in stimulating the eurozone economy. Bluntly, monetary policy alone cannot do the job, he said. But he also called for a united front on policy within the ECB itself, reflecting the intense debate and disagreement on whether negative rates are doing more harm than good.

Still, Mr Draghi was celebrated on his way out of the door as the man who saved the eurozone in the darkest days of the decade’s debt crisis, through his promise to do “whatever it takes” to protect the single currency. Ms Lagarde has already made a splash in urging governments to step up. Katie Martin

"Big" - Google News

December 23, 2019 at 12:12PM

https://ift.tt/393C4EH

The big market moments of 2019 - Financial Times

"Big" - Google News

https://ift.tt/2OUhyOE

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

No comments:

Post a Comment